capital gains tax increase 2021 retroactive

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Will capital gains go up in.

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

. Key Points President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective. Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains.

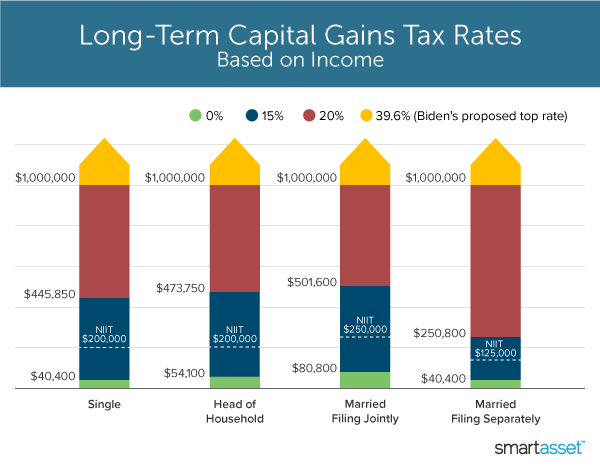

Biden plans to increase this to 434 percent for households earning. President Joe Bidens proposal to raise the capital-gains tax rate to 396 from 20 for those earning 1 million or more was first announced April 28 as part of the. If you add state.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from. Top earners may pay up to.

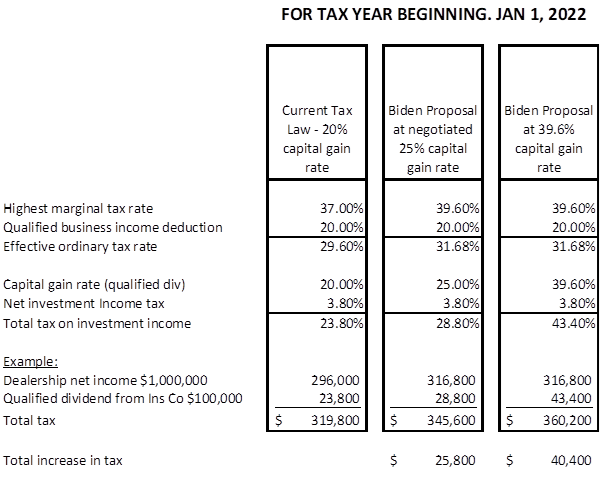

Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase. Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to. President Biden has proposed raising the top capital gains tax rate from 238 percent to 434 percent as one of several tax increase ideas for the federal budget this year.

The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. With no tax law changes your client would expect capital gains tax of 400000 per year for the next three years.

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. So what happens this time. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9. Should the proposals become law your client will now pay federal. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year.

How To Prepare For A Retroactive Capital Gains Tax Hike Thinkadvisor

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

What Are Capital Gains Taxes And How Could They Be Reformed

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Retroactive Capital Gains Tax Hike Donatestock

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

What S In Biden S Capital Gains Tax Plan Smartasset

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

Tax Changes For 2022 Kiplinger

Managing Tax Rate Uncertainty Russell Investments

Can Congress Really Increase Taxes Retroactively

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Capital Gains Tax Hike And More May Come Just After Labor Day

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

A Capital Gains Tax Hike Might Sink Stocks Here S How Financial Advisers And Their Clients Can Stay A Step Ahead Marketwatch